Unsere Leistungen

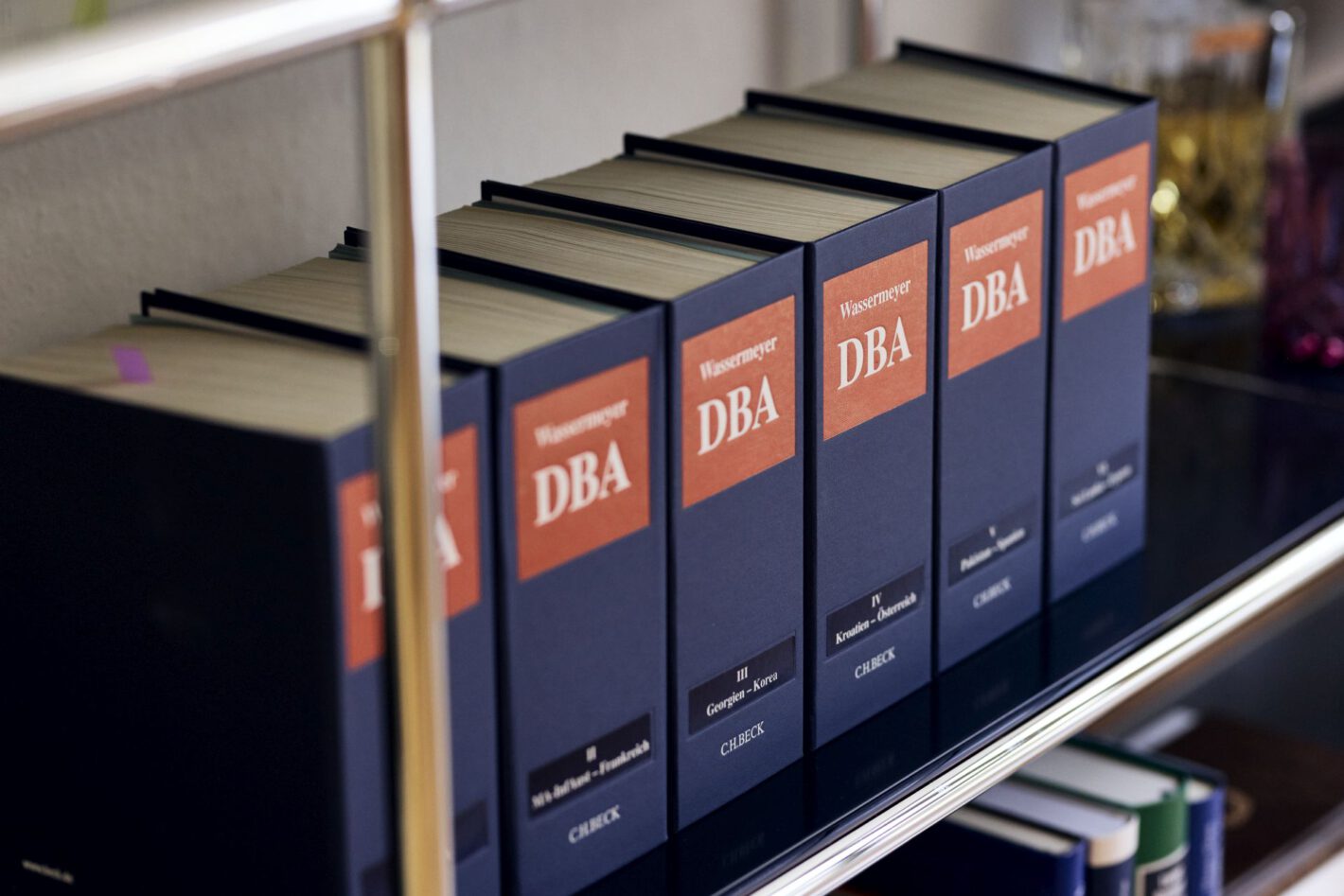

Steuerliche Beratung zu allen Themen des internationalen Steuerrechts (z.B. Weg- und Zuzug, steueroptimale internationale Finanzierungsstrukturen, Verrechnungspreissachverhalten, DBA-Recht etc.). Erstellung von Verrechnungspreisdokumentationen.

Rechtssichere Beratung zur steueroptimierten Übertragung von Familienunternehmen und Vermögen im Rahmen der lebzeitigen Übertragung als auch von Todes wegen.

Erstellung von Gutachten zur Ermittlung des Unternehmenswerts aufgrund unterschiedlicher Bewertungsanlässe. Bewertung/Begutachtung von immateriellen Vermögensgegenständen.

Steuerliche Beratung von Unternehmen zu laufenden steuerlichen Fragestellungen. Die Betreuung und Führung von Betriebsprüfungen und Klageverfahren.

Erstellung von Jahresabschlüssen und Steuererklärungen für Unternehmen aller Rechtsformen. Steuerdeklaration und laufende steuerliche Beratung für Privatpersonen.

Steuerstrukturierung (käufer- und verkäuferseitig) von Transaktionen bei mittelständischen Unternehmen einschließlich steuerrechtlicher Vertragsgestaltung.

Beratung von Unternehmen und deren Mitarbeitern bei Entsendungen oder Versetzungen von Mitarbeitern nach Deutschland oder ins Ausland. Beleuchtung steuerlicher Aspekte des Wegzugs, des laufenden Aufenthalts und der Rückkehr aus deutscher und internationaler steuerlicher Sicht.

Unterstützung in Fragen rund um ordnungsgemäße sozialversicherungsrechtliche Meldungen und die Abwicklung von Gehaltsabrechnungen.

Erstellung der deutschen Steuerklärungen